We bring you a round-up of startup and investment stories, key learnings from founders, and insights from the Founders Factory team.

Welcome to the 337 new subscribers who joined us over the past month! Help us grow our 19,140-strong community of founders, investors, and startup enthusiasts by sharing this post:

NVIDIA has redefined growth for Silicon Valley.

Since 2020, the company’s value has grown 18x, from $145 billion to $2.8 trillion. Having successfully capitalised on the AI boom through its manufacturing of chips, as well as development of GPUs, NVIDIA is now poised to overtake Apple to become the world’s second largest business by market capitalisation.

NVIDIA is just one of the many deep tech success stories that has seen the broad category of complex, science-rooted, highly technical businesses become the most coveted investments on the market. For businesses once considered capital intensive and technologically risky, this is a considerable u-turn.

In today’s Startup Bulletin, we dive into the Deep Tech Opportunity, how we define the category and why we’re so excited about it.

Also in this Startup Bulletin

Shout-outs

What we enjoyed reading this month

Highlights from the FF global portfolio

Opportunities in tech—events, job roles

📣 Before we start…shout-outs

We’d like to start off this month by shouting out our top referrer this month—Natalie Weil & Calin Coman-Enescu from Old Street Ventures. OSV is building a platform providing retail investors the opportunity to invest in VC-level dealflow.

Interested in featuring in the next edition? We’ve launched our new referral scheme on Substack:

⭐️ 5 referrals = Newsletter shoutout

⭐️ 15 referrals = Startup spotlight in our newsletter

⭐️ 30 referrals = 1-2-1 Zoom consultation with a member of our Ops Team

🤖 The Deep Tech Opportunity

Deep Tech has become a wide reaching, all-encompassing, catch-all term that has likely been used to describe anything ranging from quantum computing all the way to novel clean energy. But what actually is it, and why are we so excited about it?

There are a number of characteristics that define Deep Tech

Breakthrough. This category of technology isn’t something that already exists and is merely a new application of it. There must be something inherently novel or groundbreaking about deep tech. This is what makes it particularly exciting.

Originated in science or research. A large amount of deep tech is the result of scientific development or research, often as part of a thesis or focus of study from universities or top research facilities. Our Creator Fund is specifically poised to invest in university-based talent looking to spin out innovative research

Technology first. In many instances, the technology precedes the business itself. Deep tech founders often spend much of their time finding practical and commercial applications for the technology, around which they can then build a product and a business. The technology behind Jeevan, from our Blue Action portfolio, actually began as a water purification technology—before discovering a more scalable use for removing CO2 via direct air capture.

As a result of these things, two challenges often stand out to investors, and often stand in the way of commercialisation.

Resource & capital intensive. These businesses require large amounts of investment in order to find proof points and practical applications. Talent may be highly specialist and technical, resulting in higher operational costs. Many deep tech businesses may also be hardware businesses, meaning they can be costly to manufacture and scale.

Higher technology risk. The scientific breakthrough is just the first step, and it may still take founders a while to really validate the technology and find product-market fit. That’s why deep tech is largely grant-funded, at least in the early stages

These may be the type of red flags that would scare off certain investors, and may have been what has historically limited investment in deep tech (particularly hardware) as a category. But for us, there are enough reasons to be seriously excited:

Opportunity to create a new market. Investing in deep tech doesn’t mean capitalising on a particular trend. It means driving new trends, with the possibility of creating new categories and technologies that could gain extraordinary momentum. DRONAMICS envisioned a technology capable of transporting cargo across continents at high speed and low cost: it didn’t exist, so they built it.

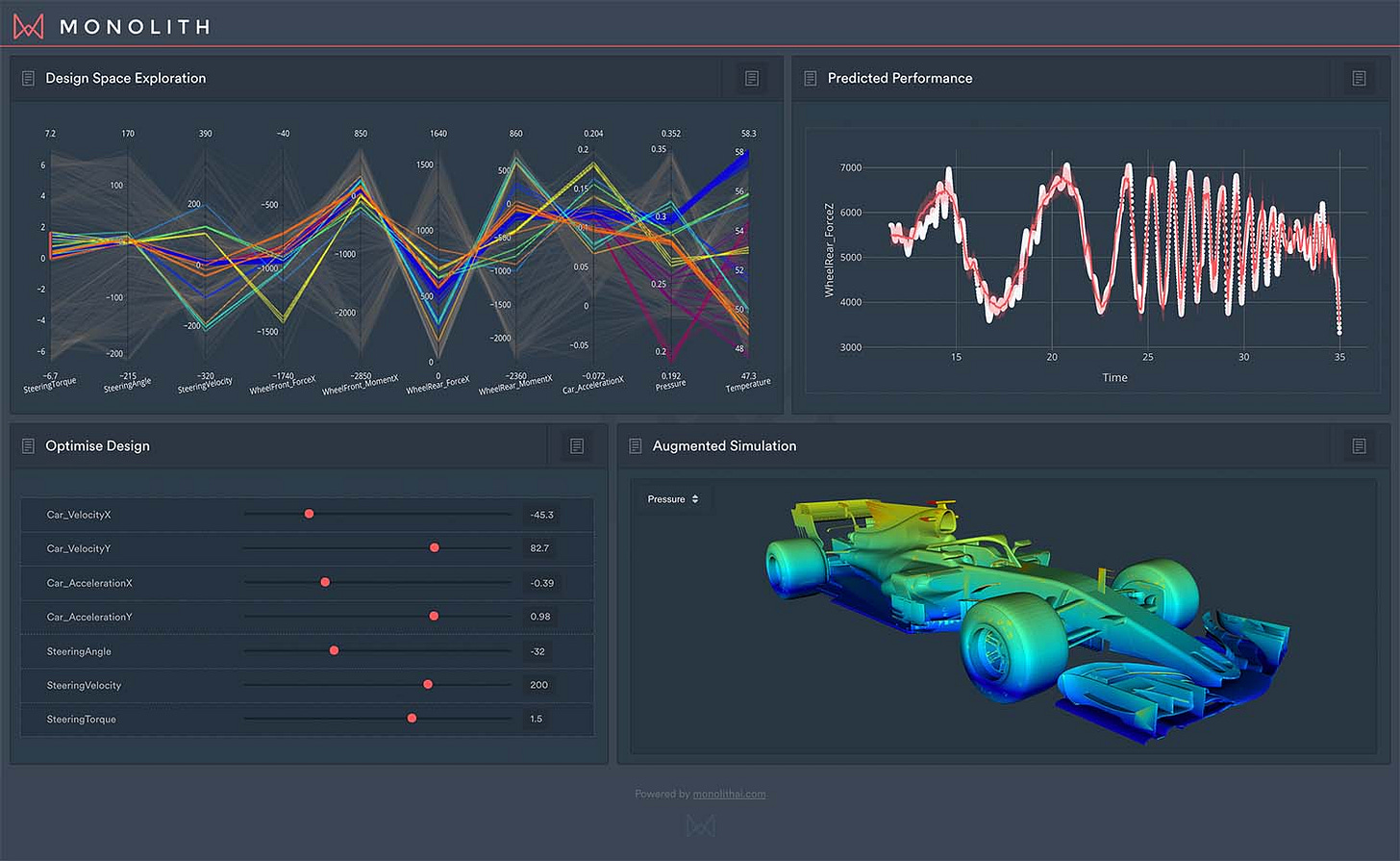

Not restricted to one particular purpose. Deep tech isn’t just a layer built on top of existing technologies. It is often the building blocks themselves, the foundations on top of which other founders and developers have the opportunity to create exciting new businesses. Monolith AI’s software has applications across numerous industries,

Opportunity to disrupt ‘hard-to-abate’ industry. Some of the most carbon intensive industries, like mining, are also the hardest to disrupt. These industries will require scientific breakthroughs to radically transform their processes across the value chain.

Potential to create groundbreaking impact. From an impact, mission-led perspective, few opportunities are more tantalising than deep tech. If we are to solve society’s biggest challenges, including the climate crisis, we’ll need to invest in the best scientists and technologists to bring breakthroughs to scale.

We are currently welcoming applications for three new Climate & Deep Tech programmes. Learn more about these programs here and how to apply:

⛏️ Rio Tinto Mining Tech Accelerator Program

🌊 Blue Action Accelerator OceanTech Program

🏞️ Western Australia Government Nature Tech Program

📚 What we enjoyed reading this month

The solar industrial revolution is the biggest investment opportunity in history (Casey Handmer)

The Unsexy Future of Generative AI Is Enterprise Apps (WIRED)

Modern Meditations: Tyler Cowen (The Generalist)

The role of AI in fintech: A 10 year horizon (Founders Factory)

🚀 Highlights from the Founders Factory community

Storyblok (pictured above) raised $80M in Series C funding, led by Brighton Park Capital with follow-on from Mubadala, firstminute capital, and HV Capital, to build out their headless CMS platforms

Iris.ai announced their $7.6M Series A funding round, led by Silverline Capital with funding from the European Innovation Council. They’re building an AI to help organisations extract insights from vast volumes of data and research

StructureFlow closed $6M in Series A funding, led by FINTOP Capital, with follow-on from Venrex, to build out their legal services data visualisation tool for complex deals and transactions

Insurtech Eleos also celebrated fundraising success, closing a $4M seed round led by Fuel Ventures and Indico Capital. They’re bringing focus and innovation to life insurance and income protection

Across the pond, healthtech Mae also closed their latest funding round led by impact-first healthcare investor Jumpstart Nova. Mae is building a community support platform for expectant Black mothers

Our CEO Henry Lane Fox and Creator Fund CEO Jamie Macfarlane appeared in conversation at the recent Tech.EU summit, to discuss ‘Finding Hidden Gems in Deep Tech’

We launched our investment themes for our new programmes with Rio Tinto and the Government of Western Australia. Learn about our Mining Tech and Nature Tech programmes

We held our first Women in Fintech event, bringing together over 40 women from across the industry at Founders Factory HQ

GridShare launched their first crowdfunding campaign to help people invest in and co-own newly constructed solar farms in Italy. Founder Giovanni appeared in Italy’s La Repubblica to outline the vision of the company

AtmoCooling were one company featured in Sifted’s spotlight of climate tech in the Middle East, highlighting their atmospheric temperature-influencing technology in the UAE

Opportunities

📅 Events

London Tech Week (June 10th - 14th)—an annual celebration of technology in the UK capital, bringing together top founders from home and abroad. Have a look at the agenda and how to secure a pass here

Tech Nation Pitch Showcase (July 3rd)—TN is hosting two pitch events for their Libra (underrepresented founders) and Climate cohorts. Find out more & apply to attend here

💼 Job roles

We’ve got a number of open roles across our team and portfolio, which you can check out here. Here are three highlights:

Deep Tech Investor (London or New York)

Tech & Data Lead (London)

CTO/Technical Co-founder @ Project Re:geno (Agtech Startup)

See you next month 👋

Interested in reading more of the same insights? Check out the Founders Factory blog, and previous newsletters.